Offshore Tax havens levy little or no taxes to foreign investors without setting foot in the country. Some of these havens offer financial secrecy by refusing to share information with international tax authorities. There are only few handful tax havens in the world right now, what we can call ‘pure’.

According to IMF, wealthy individuals have stashed $7 trillion, corresponding to roughly 10 percent of world GDP in tax havens, while American Fortune 500 companies hold an estimated $2.6 trillion offshore (2017 figures). The demand for tax reduction will grow among wealthy individuals and corporations in the coming years due to globalisation and emerging new digital technologies, and mobility . International Tax planning is an important tool cannot be ignored by HNWI and wealth managers around the world.

Major havens in the world are located in advanced economies or in their territories. The Caribbean is home to world’s top tax havens. We have identified 10 places on earth that are pure tax havens, based on zero taxes on corporate tax, personal income tax and VAT. These tax havens are also the richest in the world. Half of the top tax havens in this list are British overseas territories.

Pure Tax Havens

Offshore Financial Centers (OFC) are small, low-tax jurisdictions that provides financial and corporate services to non-resident clients. There are basically 3 ranking indexes that scores tax havens around the world

- Financial secrecy index (FSI) for 2022

- CORPNET OFC (sink and conduit ranking)

- Corporate Tax haven index (CTHI) for 2021

According to FSI, United States, Switzerland and Singapore are the top countries with highest financial secrecy, complicit in helping individuals to hide their finances from the rule of law. BVI, Cayman and Bermuda are also notorious corporate tax havens, according to CTHI.

Before we move on, you should know a bit about sink and conduit on financial inflows in OFC

- Sink: a jurisdiction in which a dis-proportional amount of value disappears from the economic system.

- Conduit: a jurisdiction through which a dis-proportional amount of value moves toward sink-OFCs.

1.British Virgin Islands (BVI)

FSI Rank: 9 (2022)

CTHI Rank: 1

Sink Rank: 1

- Corporate tax – 0%

- Personal Income tax – 0%

- VAT – 0%

BVI is a British overseas territory (not a country), a popular destination for US tourists. It is one of the oldest and biggest offshore tax haven for incorporating offshore companies due to its stable climate and english common law. It is also a biggest destination for investment funds, especially hedge funds ( financial partnerships that use pooled funds). Some $125 billion is invested every year in BVI

The strong regulatory framework, US dollar local currency make the center all the way more interesting. BVI is also one of the wealthiest territory in the caribbean.

British Virgin Islands (BVI) should not be confused with Virgin Islands (USVI), a US territory

A quick summary of taxes below..

- no capital gains tax,

- no gift tax,

- no sales tax or value added tax,

- no profit tax

- no inheritance tax or estate duty, and

- no corporation tax.

2. Bermuda

FSI Rank: 49

CTHI Rank: 2

Sink Rank: 4

Bermuda is one of the richest and biggest offshore financial centers in the world, also being a british overseas territory, conveniently located approx 650 miles off in the US coast of North Carolina. It is not part of Caribbean but a member of CARICOM (Caribbean Community). The financial services industry contributes to 85% of GDP.

Bermuda is a very popular tax avoidance destination due to its stable climate. Out of 400 securities listed in stock exchange, 300 are offshore funds. In 2011, Google saved $2 billion in taxes by shifting $10 billion through Bermuda subsidiary through Dutch-Irish tax strategies.

- Corporate tax – 0%

- Personal Income tax – 0%

- VAT – 0%

Bermuda levies payroll tax on employers and land taxes. Investment Funds are registered in Bermuda by asset managers. This is due to no taxes on income, dividends or capital gains. Bermuda does not report income or ownership to any government agency and offshore trusts incorporated in Bermuda are used for asset protection. One disadvantage with Bermuda is there is high import duty levied on products imported into the country.

Here is a list of taxes

- Taxation of investment income and capital gains – not taxed.

- Dividends, interest, and rental income – not taxed; and there is no withholding tax on such payments.

- Gains from employee stock option exercises – stock option gains are subject to the payroll tax. Capital gain on disposition of shares not taxed.

- Foreign exchange gains and losses – not taxed.

- Principal residence gains and losses – not taxed.

- Capital losses – not applicable.

- Foreign property reporting – not taxed.

- Non-resident trusts – not taxed.

3. Cayman Islands

FSI Rank: 14

CTHI Rank: 3

Sink Rank: 5

The Cayman islands is one of the world’s most popular offshore financial center and tax haven, home to multinational corporations banks, insurance firms, investment funds and wealthy individuals. It is one place in the world where there are more mailboxes and registered companies than people who actually live there. It is still British overseas territory providing offshore services to 100,000 registered companies. Tourism, offshore financial and income from indirect taxes makes the islands financially self reliant.

Cayman is particularly popular due to its tax neutral status for investment funds. The Cayman has a scheme for permanent residency for investors.

- Corporate tax – 0%

- Personal Income tax – 0%

- VAT – 0%

- Capital gains tax: 0%

The Cayman Islands levy no taxes on income, dividends, royalties, profits, capital gains, wealth, property, or transfers, including transfers on death, on either resident or non-resident individuals, according to KPMG.

Cayman Islands levies import duty but books, cameras, gold, and perfume are exempted.

4. Bahamas

FSI Rank: 22

CTHI Rank: 9

Sink Rank: 14

The Bahamas is the richest country in the americas after US and Canada, most popular for offshore entities. It is a top tax haven for no income tax, corporate tax, capital gains tax, or wealth tax. The Government makes much of the income from tourism, VAT, property taxes and import duties

Bahamas is particularly popular for US investors due to its proximity to US coast of Miami, stable government and economy, sound legal framework, modern infrastructure, proximity to key markets making it an ideal investment destination.

- Corporate tax – 0%

- Personal Income tax – 0%

- VAT – 12%

- Property taxes – 0.75% (on $500K)

5. Anguilla

FSI Rank: 58

CTHI Rank: 35

Sink Rank: 17

Anguilla is a British overseas territory in the Caribbean, renowned for its spectacular and ecologically significant coral reefs and beaches. A popular tax haven and zero tax jurisdiction with no capital gains, estate, profit, sales, or corporate taxes. Offshore companies pay no taxes as long as all their incomes are earned abroad. The company incorporations are much faster possible within a day.

Anguilla in 2019 launched a tax residency program

- Corporate tax – 0%

- Personal Income tax – 0%

- VAT – 0%

6. UAE

FSI Rank: 8

CTHI Rank: 12

Sink Rank: –

UAE (Dubai) is has become fastest growing offshore tax haven and financial center in the middle east and gulf region. Its strategic geographical location, oil wealth, luxury real estate market and 100% foreign ownership in companies has made UAE a biggest financial center in the world. UAE has the world’s third biggest sovereign wealth fund in the world amounting to $697 billion (

In recent years, UAE has grown to become a biggest market for second citizenships and passports. UAE offers residence rights to foreign investors

The UAE government implemented value added tax (VAT) in the country from January 1, 2018 at a standard rate of 5%. Personal income taxes are exempted for individuals but not for foreign banks and oil companies. VAT is exempted for residential properties and bare lands.

Corporate tax – 0%

Personal Income tax – 0% (for individuals)

VAT – 5%

7. St.Kitts & Nevis

FSI Rank: 68

CTHI Rank: –

Sink Rank: –

St Kitts and Nevis is a thriving financial center and a tax haven for offshore investors. It is a small and also a wealthiest countries in the caribbean with just a population of 50,000 residents. St Kitts is home to offshore companies, banks and insurance companies. Recently the country passed a virtual coin legislation to attract blockchain and crypto startups.

St Kitts also offers passports for investments through the citizenship investment scheme. This scheme remains oldest in the world operating since 1983. Investors are not required to live in the country.

- Corporate tax – 0%

- Personal Income tax – 0%

- VAT – 5%

- Capital duty: none

- Payroll tax – None

- Inheritance/estate tax – None

- Wealth tax – none

- Capital gains – None (if sold within 1 year)

8. Bahrain

FSI Rank: 60

CTHI Rank: –

Sink Rank: –

Bahrain is one of the oil rich countries in the middle east. Bahrain is home to world’s largest financial institutions including multinational firms that specialize in islamic banking and other financial services.

The Kingdom Bahrain has no personal income tax. But citizens must pay 7 per cent of their income in social security while expats pay 1 per cent. There are also taxes on renting homes and stamp duties on real estate transfers. Recently the Kingdom has introduced golden residency scheme to attract foreign investment.

Corporate tax – 0% (not exempted for oil and petroleum companies)

Personal Income tax – 0%

VAT – 5%

Capital gains – None

Capital duty – None

Payroll tax – None

9. Kuwait

FSI Rank: 35

CTHI Rank: –

Sink Rank: –

Kuwait is one of the wealthiest countries in the world due to its oil wealth. The Kuwaiti dinar is the highest-valued unit of currency in the world. Its sovereign fund funded by oil is the fourth biggest in the world worth atleast half a trillion.

There is no personal tax in the state of Kuwait. Corporate income tax is imposed only on the profits and capital gains of foreign corporate bodies conducting business or trade in Kuwait, directly or through an agent. Corporate taxes are exempted by corporations owned by Kuwaiti or GCC nationals.

Corporate tax – 0%

Personal Income tax – 0%

VAT – 0%

Zakah – May be applicable

10. Sark

Sark is one last place in the world where there are no personal or corporate income taxes. Sark is the smallest independent feudal state (5km2) in Europe population of just 600, part of the Channel Islands in the southwestern English Channel, off the coast of Normandy, France. It is neither part of UK or EU.

Sark is fiscally autonomous from Guernsey, and consequently has control over how it raises taxes. economy depends primarily on tourism and financial services. Sark has no company registry but relies and regulated by Guernsey’s financial services commission. Sark is one of the most secluded places in the world. There are no taxes on income, capital gains or inheritances. There is also no VAT charged on goods and services. It is a pure tax haven since there are no tax offices and no agreements with UK or any other country.

An individual is considered to be a resident for tax purposes if they have remained on the island for at least 90 days in any tax year

Corporate tax – 0%

Personal Income tax – 0%

VAT – 0%

Double Irish Dutch Sandwich

The “Double Irish with a Dutch sandwich” is a tax avoidance technique employed by certain large corporations, involving the use of a combination of Irish and Dutch subsidiary companies to shift profits to low or no-tax jurisdictions. These techniques are most prominently used by tech companies because these firms can easily shift large portions of profits to other countries by assigning intellectual property rights to subsidiaries abroad.

Phantom Investments

Globally, phantom investments amount to an whopping $15 trillion, or the combined annual GDP of economic powerhouses China and Germany. According to IMF, about $40 trillion in FDI is being channeled around the world, multinational firms have invested $12 trillion globally in empty corporate shells (‘phantom investment’), and citizens of some financially unstable and oil-producing countries hold a disproportionately large share of the $7 trillion personal wealth stashed in tax havens. A few well-known tax havens host the vast majority of the world’s phantom FDI. Luxembourg and the Netherlands host nearly half. And when you add Hong Kong SAR, the British Virgin Islands, Bermuda, Singapore, the Cayman Islands, Switzerland, Ireland, and Mauritius to the list, these 10 economies host more than 85 percent of all phantom investments. Hong Kong SAR, Macao SAR, and Singapore are notorious Asian tax havens.

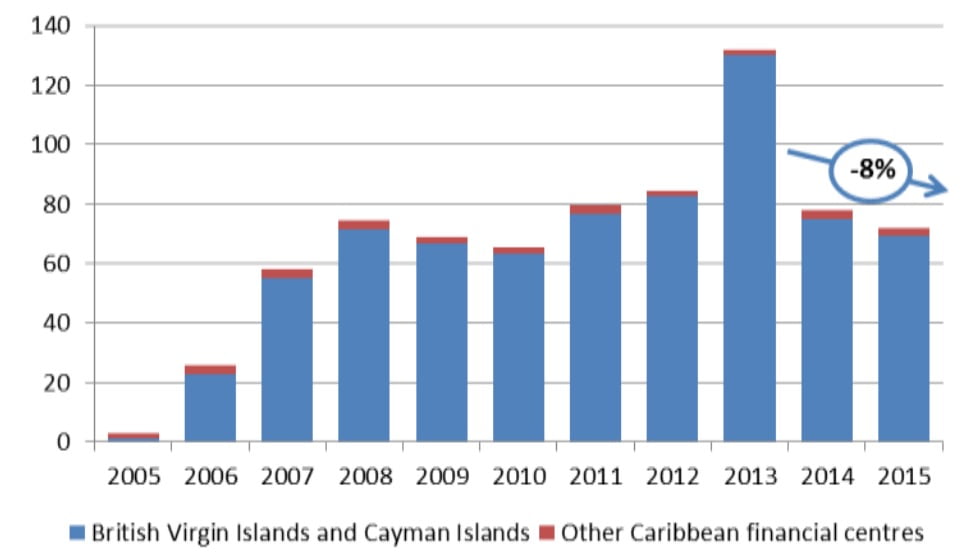

Figure: Investment flows to Caribbean offshore financial centers, 2005-2015 (Billions of US dollars) – Source: UNCTAD

US as a Tax Haven

The US itself a biggest tax haven in the world, thats one way to look at it. US scores top marks for financial secrecy as it refuses to share tax information with OECD.

- Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming—levy no personal income tax

- South Dakota and Wyoming are the only states that do not levy a corporate income taxes

- Nevada and Delaware – popular for company incorporations. (50% of the companies listed in NYSE are incorporated in delaware)

- Puerto Rico – Emerging Tax haven for the Rich from the Federal government. Puerto Rico is a not a US state, considered a territory. By ‘residing’ on the island for 183 days per year, these individuals can avoid both Federal and local taxes.

Singapore

Singapore’s major attraction as financial capital of Asia offers low corporate tax rate and top personal tax bracket, and it does not levy taxes on capital gains. Singapore is also home to private investment funds and family offices.

European Tax Havens

European tax havens act as an important part of the global flows to tax havens, with three of the five major global Conduit OFCs being European (e.g. the Netherlands, Switzerland, and Ireland). Four European-related tax havens appear in the various notable § Top 10 tax havens lists, namely: the Netherlands, Ireland, Switzerland, and Luxembourg. British Overseas Territories are the leading traditional and corporate tax global tax havens, including the U.K. itself. Jersey, Monaco, Gibraltar, Guernsey play a role as sinks.

The Top tax havens in Europe are

- Netherlands

- Switzerland

- United Kingdom

- Luxembourg

- Belgium

- Cyprus

- Malta

- Bulgaria

Netherlands – Netherlands is a tax haven for company incorporations, the country does not tax incoming dividends and royalties. Further “mailbox” companies pay only limited corporate tax.

Ireland – Ireland is attractive for many large tech companies, thanks to its low corporate tax rate of 12.5%.

Switzerland – Attractive for corporations with low tax rates and privacy laws. Home to major holdings of crypto assets.

Luxembourg – International financial center attractive for bond investors, corporations benefit from low tax rates and privacy laws

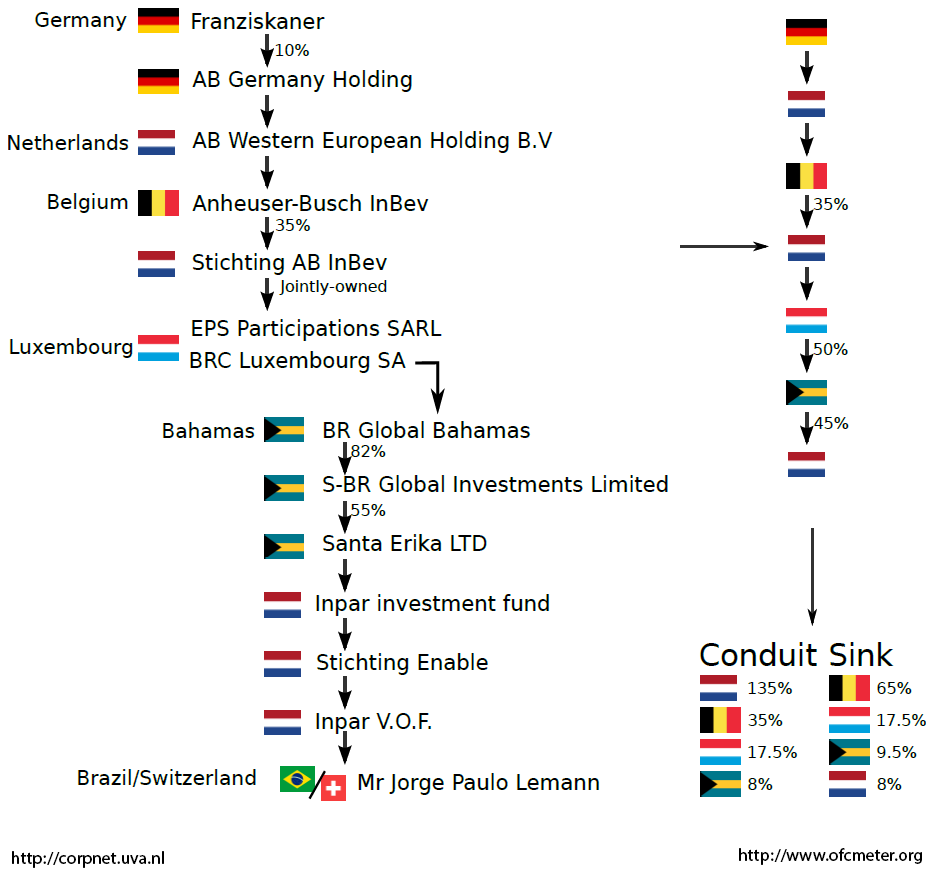

Here is an example of european tax havens used in the global corporate ownership chain (left), a country chain (top right) and sink/conduit scores (bottom right). Example may not reflect current corporate structure

Comparison

Increased clampdown and major regulations (FATCA, OECD CRS) and AML regulations on banks to check against illicit wealth has hit tax havens hard and many have disappeared into oblivion. The leak of Panama papers have almost destroyed Panama’s name and status as offshore tax haven and financial center. In IMF’s Coordinated Direct Investment Survey, a whopping $12 trillion—almost 40 percent of all foreign direct investment positions passes through empty corporate shells with no real activity bring no economic benefit.

Here is a quick summary of corporate and income taxes in tax havens.

| Tax Havens | Corporate Tax % | Income Tax % | VAT % |

| Anguilla | 0 | 0 | 0 |

| Bahamas | 0 | 0 | 12 |

| Cayman | 0 | 0 | 0 |

| Kuwait | 0 | 0 | 0 |

| St Kitts and Nevis | 0 | 0 | 0 |

| Sark | 0 | 0 | 0 |

| UAE | 0 | 0 | 5 |

| British Virgin Islands (BVI) | 0 | 0 | 0 |

| Bahrain | 0 | 0 | 5 |

| Bermuda | 0 | 0 | 0 |