Portugal’s hospitality sector is an important growing market, backed by foreign tourists and investor interest via golden visas, contributing significantly to the national economy. The hospitality sector witnessed impressive growth rebounding from post pandemic levels, covering 1/3 of commercial real estate investments. destinations like Lisbon, Porto, and the Algarve remained strongholds of growth, there was a notable surge in visitor numbers. Portugal is attracting significant international investment, with international hotel brands rapidly expanding their presence into key cities creating more jobs and tax revenues for Portugal.

Tourism Drives Hospitality

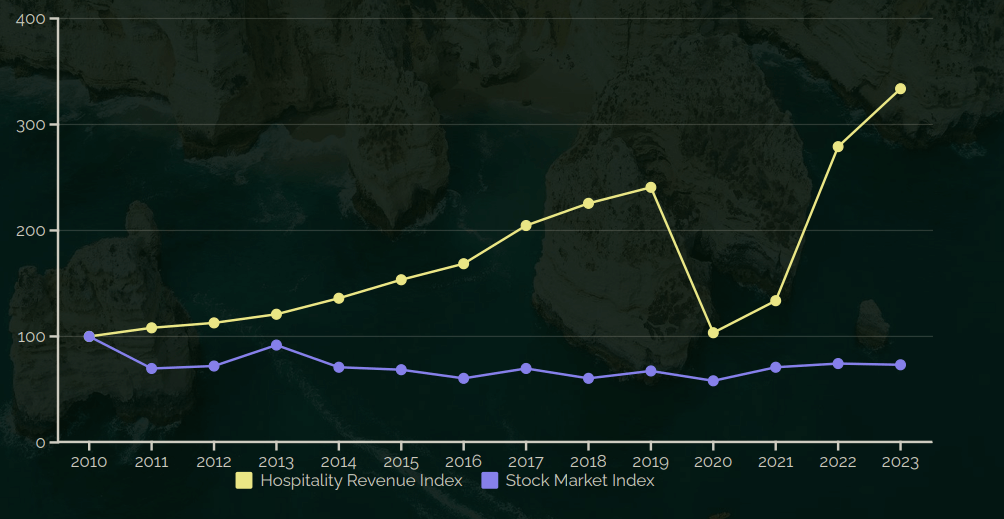

Portugal’s tourism industry continued to thrive in 2024, attracting millions of visitors from around the world. Known for its rich history, scenic coastlines, and vibrant culture, the country remained a top destination in Europe. Over the past 15 years, hospitality revenue has demonstrated consistent growth, only interrupted by a temporary decline during the COVID-19 pandemic, followed by a strong and sustained recovery. Post-pandemic, the sector continued its upwards trajectory.

Growth Chart

The chart below illustrates the steady growth of hospitality revenue in Portugal and its rapid rebound following the pandemic. Using 2010 as the baseline (index 100), revenue reached index 334 in 2023—more than tripling in just over a decade.

According to Portugal Hotel Chains report,

- Revenue per Available Room (RevPAR) rising to €112.6.

- Hotel revenues increased by 12%,

- Room occupancy rate reaching 62.3%.

- American arrivals increasing by 13% year-onyear.

According to Statista, The Hotels market in Portugal is predicted to witness an upward trend with respect to revenue, with an estimated value of US$1.15bn in 2025. The expected annual growth rate (CAGR 2025-2030) is 5.85%, leading to a projected market volume of US$1.53bn by 2030.

Figures from INE statistics office reveal, Overnight stays in tourist accommodation establishments (hotel, local accommodation with 10 or more beds and rural and lodging tourism) yielded growths of 11.0% in both total and accommodation revenues in 2024, totalling EUR 6.7 billion and EUR 5.1 billion. The tourist accommodation sector accounted for 3.4 million guests (+4.3% ) and 9.4 million overnight stays (+3.5%) in July 2025. The revenue per available room (RevPAR) was EUR 101.1 (+5.1%), while the average daily rate (ADR) was EUR 151.8 (+5.6%) .

Golden Visas

Golden visas are also key driver creating demand and growth in hospitality market, as many private equity investment funds invest in hospitality sector for good returns from hotel operations, constantly outperforming real estate returns and stock markets. We offer only one handpicked hospitality fund – Prime hospitality fund to clients. The fund invests in prime assets such as operate hotels in prime locations with high occupancy rates focused on long term growth.

- Low risk fund focused on long term growth with low fees.

- Avoids direct or indirect investments in real estate, with invested companies holding no real estate assets on their balance sheets

- Allocates at least 60% of investments to Portuguese entities and has an 8-year maturity, exceeding the 5-year minimum requirement

- Fund Is incorporated under Portuguese law, supervised by the Portuguese regulator (CMVM), and managed by a licensed fund manager with over 20 years of market presence

How does Prime Fund work?

Portugal Prime Fund invests in operating companies with no real assets on their balance sheets. These companies provide secured loans to property owners in exchange for operating leases and equip the properties with the equipment, fixtures, and furnitures to operate. The secured loans are backed by the properties, which serve as collateral and offer protection to investors — while complying with GV regulations.

Please contact us for a free consultation.