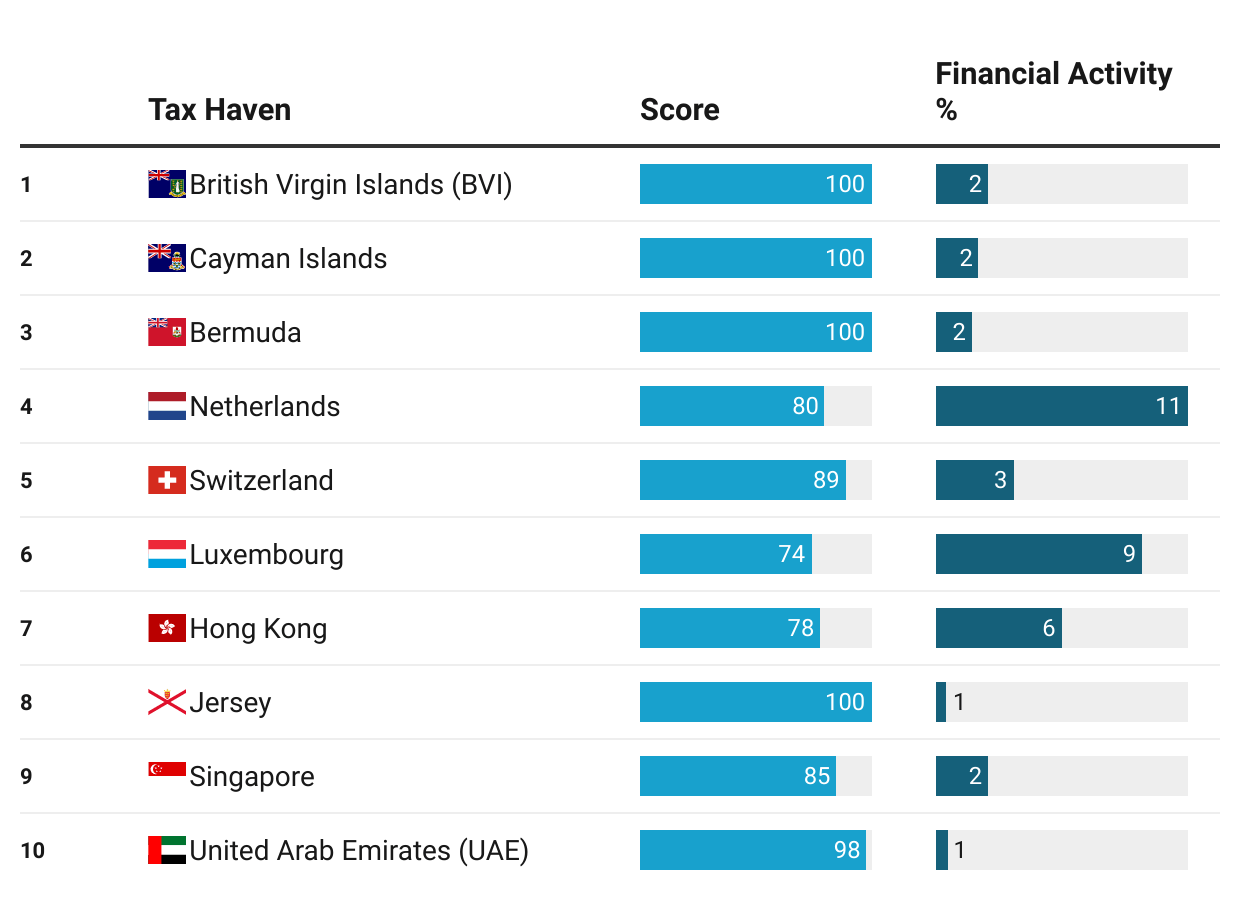

British Virgin Islands and Cayman Islands are the world’s most popular corporate tax havens in the world for 2021 according to Corporate Tax Haven Index (by Tax Justice Network) which publishes a ranking of jurisdictions most complicit in helping multinational corporations underpay corporate income tax. Bermuda takes the third place. Switzerland and Luxembourg are major secrecy jurisdictions and also very large corporate tax havens. Netherlands and Luxembourg has the highest amount of corporate financial activity in the table.

Top 10 Corporate Tax Havens

| Tax Haven | Score |

Financial Activity %

|

| British Virgin Islands (BVI) | 100 | 2.3 |

| Cayman Islands | 100 | 1.9 |

| Bermuda | 100 | 1.6 |

| Netherlands | 80 | 11 |

| Switzerland | 89 | 3.4 |

| Luxembourg | 74 | 9 |

| Hong Kong | 78 | 5.5 |

| Jersey | 100 | 0.51 |

| Singapore | 85 | 2.3 |

| United Arab Emirates (UAE) | 98 | 0.54 |

Source: CTHI Tax Justice Network

The Haven Score for each jurisdiction is constructed from 20 Haven Indicators, which reflect the many different rules, laws and mechanisms that multinationals can use to escape tax. The Score is a measure of how much scope for corporate tax abuse the jurisdictions’s tax and financial systems allow. 0 means no scope, 100 means unrestrained scope. The amount of financial activity conducted by multinational corporations around the world is hosted by the jurisdiction.

What is a Corporate Tax Haven?

Corporate tax havens attract multinational companies by offering facilities to escape or undermine the tax laws, rules and regulations of other jurisdictions, reducing their tax payments in these jurisdictions. The State of Tax Justice 2022 finds that at least 1 of every 4 tax dollars lost to multinational corporations using tax havens. In 2021,the world was losing over $483 billion a year in tax to multinational corporations and wealthy individuals using tax havens to underpay tax. For a century, Multinational corporations were required to only report how much profit and loss they made in total at a global level. They did not have to report how much profit and loss they made in each country they operated in. This meant multinational corporations could move money around the world to make it look like they didn’t make any profit in the countries where they would have to pay tax and, coincidentally, made billions in profit in tax havens where they sell no goods or services, employ no staff and have no offices, factories or tangible assets.