Bahamas offers immediate permanent residence certificate without any trips to the country to UHNW foreigners investing in real estate or buying a home in the island. It is one of a kind residency program, suited for HNW and UHNW clients.

Bahamas is one of the richest countries in the caribbean popular for holiday makers and prime demand in real estate market.

Bahamas is sovereign country, with strong regulatory oversight and sensitivity to the requirements of a global market, The Bahamas is committed to the financial services industry. Aspects of the Bahamas environment that have supported the development of this industry over the last 60 years include:

- Independent judicial system, based on English Common Law;

- Long history of constitutional democracy, dating back to 1729;

- Large, diverse and highly-skilled professional community;

- Easy access, located at the crossroads of the Americas, with many direct flights each day from America and Europe;

- Absence of exchange control for non-residents;

- Modern and accommodating legislative framework;

- No personal or corporate income, capital gains, estate, gift or inheritance taxes;

- Regulatory environment that is conducive to investment opportunity, while maintaining the highest international standards of operation and conduct

- Public/private sector cooperation

Golden Visa

Bahamas issues two types of residence permits for property investors

- Annual Residence permit

- Permanent residence permit

1. Annual Residency

Foreigners who are owner of a property valued at a minimum of $250,000 you can apply for Bahamas annual residency.

2. Permanent Residency

Ther Permanent residence is issued to Financially independent individuals or investors who are legitimate owners of a residence in the Bahamas. Please note that persons purchasing a residence for BSD $750,000.00 or more (USD $750,000) will get speedy consideration. The conditions for fast track permanent residence is

- No criminal record;

- Must purchase property valued at more than $750,000; or

- Own or have a beneficial interest in a business in The Bahamas which is in a growth category and which supports the employment of Bahamians;

- Must demonstrate sufficient resources in cash, investments or salary, to be self-supporting without the need to be employed in The Bahamas;

- Must show that property tax payments are current.

The PR certificate offers all residence rights similar to Bahamians, except right to vote.

All foreign nationals who are desirous of living for any purpose other than working in the Bahamas, must seek authorization from the Department of Immigration for Annual Permit.

Bahamas does not oblige you to keep your real estate investment once you have obtained the P.R status. The Property can be held under the name of person or legal IBC.

Fees

- Government fee: USD 1,000.00 for an annual residency and USD 15,000 for permanent residency card.

- Legal fee: USD 15,000 for an annual residency permit, and USD 20,000 for a permanent residency permit

Real Estate

foreigners who are non citizens can freely invest in real estate with a permit from Foreign investment board under the International Persons Landholding Act, under the following conditions:

- The property being purchased is greater than 2 acres.

- The intention is to rent out all or a portion of the property.

- The property being purchased is for commercial development.

Property Taxes

The Assessment of Real Property may fall in the one of the following categories:

- Owner Occupied

- Residential

- Commercial

- Vacant Land

The following taxes apply on properties.

- Stamp duty – 10% (above $100,000 shared between buyer and seller)

- Annual Property tax – 1% (above $500k upto $5m) and 0.6% (between $250k to $500k)

- VAT – 12% on real estate services (First-time Bahamian buyers may be exempted from VAT on a dwelling house or vacant land purchased for a dwelling house, up to the value of $500,000 )

- Additional costs – Legal fee, broker fee, insurance

Bahamas has no income tax, capital gains taxes or inheritance taxes.

Personal Visit

Due to Covid, We do NOT require the client to come to the Bahamas to obtain his documents.

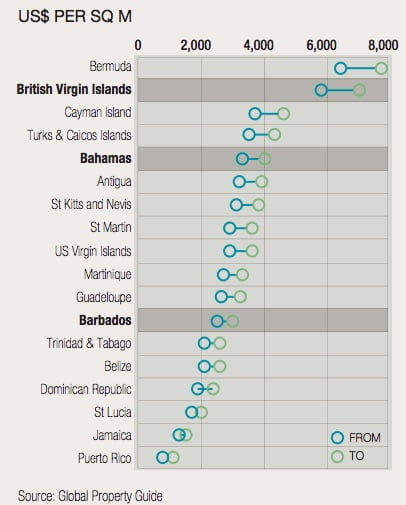

Property prices

Bahamas flourishing real estate market has the highest per square meter prices in the caribbean region. The property prices in Bahamas cost upto a maximum of $4000 per square meter.

We have developments available USD 319,000 to USD 895,000 near the beach.

Tax Residency Certificate

Bahamas also offers tax residency certificate to permanent resident investors who spend atleast 90 days in a year in Bahamas.

Bahamas currently has Tax information exchange agreements (TIEAs) with Argentina, Aruba, Australia, Belgium, Canada, China, Denmark, Faroe Islands, Finland, France, Germany, Great Britain and Northern Ireland, Greenland, Guernsey, Iceland, India, Japan, Korea, Malta, Mexico, Monaco, New Zealand, Norway, Poland, San Marino, South Africa, Spain, Sweden, The Netherlands, United States.

Bahamian Citizenship

Foreigners can naturalize for Bahamas citizenship after being legal permanent resident in The Bahamas who has had the legal status for 10 years, including the 12 months immediately preceding the date of application, and who has resided in The Bahamas for a minimum of 6 years preceding the 12 months mentioned above

Bahamas Passport

The Bahamian passport is also a strong passport in the world having visa free access to 150+ countries. The passport holders have visa free access to China, EU schengen states, United Kingdom and United States ( if traveling through the Preclearance Facilities at Nassau or Freeport airports)