Today, we are launching Sovereign Citizenship Fund – A new model for Governments seeking revenues from citizenship by investment programs. The fund is fully owned, managed and controlled by the state or central banks.

It is a first of kind sovereign fund in the CBI industry, fully funded by citizenship revenues as assets. It is carefully structured offering 90% liquidity, stabilization economy, paying debts, and very importantly contribute to disaster management and social welfare projects such as hospitals, education, sports, research and science under one single package.

- Fund can be held in any currency

- Portfolio can be decided by governments.

- Fully customizable, open, transparent and free to use for anybody

Regional model

This citizenship fund can can also be extended and used as regional model controlled by central banks. For example. 5 caribbean countries are running a citizenship investment schemes, each country can contribute a part of revenues to a central citizenship fund for developments in the caribbean region, managed by common central bank.

To develop a Sovereign citizenship fund (SCF) in the ECCU, member governments actively involved in CIP can provide a percentage of excess revenue to the Sovereign Citizenship Fund (SCF) on a monthly, quarterly or annual basis.

What is Sovereign Citizenship Fund?

A citizenship fund is funded by revenues from citizenship for sale schemes currently run in over 10 countries in the world. This is fully funded by one time contribution option in exchange for citizenship. The fund can also include Govt fees or any other passport revenues.

The Sovereign Citizenship Fund (SCF) will be free, transparent and fully customizable model for governments that depend on CIP revenues for disaster management and social welfare projects. This fund is a best war chest for uncertain times of small countries. It is important to understand this fund helps governments to achieve economic growth without increasing their debt

The model requires all the assets in the fund to be insured

A special committee appointed by government will operate the sovereign fund in a transparent way, manage and make decisions on the fund to prevent corruption and misuse of funds.

We have designed the fund assets to be more liquid for immediate consumption and rest invested for future spending. Immediate spending of sovereign fund assets risks causing the economy to overheat, and it is more desirable to spend the assets at low inflation.

Why such a fund is important?

Citizenship programs have been a lifeline for small countries from natural disasters (eg. Caribbean, Pacific). These countries are also the most vulnerable countries in the world. These countries spend atleast $50 million annually for natural disasters every year. Any instant hurricane strike, earthquakes or a pandemic put these countries trapped in negative debt.

We are seeing this every year and time after time. In 2017, Hurricanes destroyed GDP of caribbean countries – Antigua and Dominica forcing these countries to become climate resilient. When Hurricane Dorian hit Bahamas in 2019, it left 70,000 people homeless. Elsewhere in the Pacific, Vanuatu and other countries have the same story.

Yes citizenship for sale is a controversial industry often criticised, think about it – for many small islands, only the revenues generated from citizenship schemes comes to the rescue, during ultimate disasters. International aid, loans and other relief supplies takes days/weeks to arrive.

Asset Portfolio

The Asset portfolio will comprise of 90% liquid available for immediate consumption of CIP countries. This can be fully customized by governments on where to invest in state’s interest.

It is very important the atleast 90% of assets in the SCF fund to be fully liquid (cash equivalent) for immediate use and consumption. Covid-19 has taught us a very valuable lesson. In the Pacific some islands faced double disasters (pandemic/cyclone). The cyclone relief effects significantly delayed due to Coronavirus, shows the importance to keep the disaster relief funds for immediate consumption.

Spending

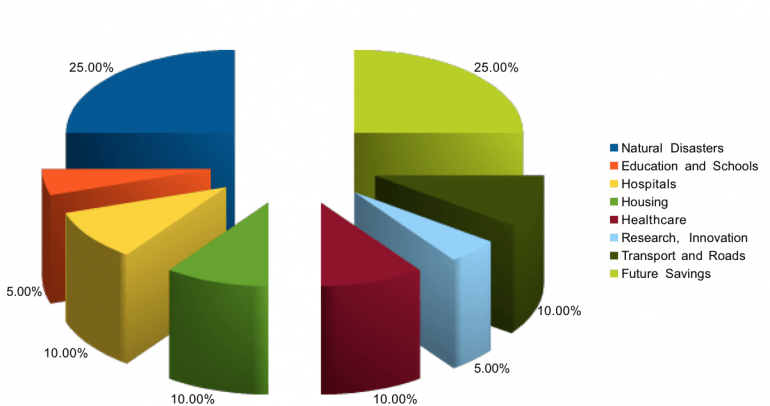

The Sovereign fund can be spent on social and welfare projects, and most importantly reserved savings for natural disasters (hurricanes) and also future savings (25%) and the rest for schools education, hospitals, health care, housing, research and innovation, sports, cultural activities (museums). The Special committee will make decisions on how and when to spend.

This model can also be fully customized by the state which owns the fund. A special committee will make approve decisions on spending.

- Disaster Recovery

- Hospitals

- Healthcare

- Housing

- Research & Development

- Pensions

- Public Debt Reduction and Repaying Loans

- Infrastructure projects

- Law and order

- Disabled, Blind and socially disadvantaged people

- Climate Resilient projects

An example of allocation is presented below..

Special Committee

The model also requires governments must form a special member committee to regulate and make decisions on Sovereign citizenship fund such as annual spending, portfolio, allocation of reserves etc. This will prevent corruption, abuse and the committee will function in a fully transparent manner publishing annual reports to public.

Assuming the fund has more liquidity, the interest earnings collected from the fund can be used to pay for expenses and salaries running the special committee.

Citizenship Revenues

Today there are over 10 CBI schemes running bringing the much needed revenue to countries. These programs make citizenship investment programs a $5 billion dollar industry yearly as of 2020

| CBI Country | Year | Fund Revenues |

| St Kitts and Nevis | 1983 – 2020 | USD 1 billion* |

| Dominica | 1993 – 2020 | USD 600 million* |

| Grenada | 2013 – 2020 | USD 118 million |

| Vanuatu | 2014 -2020 | USD 230 million. |

| Antigua and Barbuda | 2013 – 2018 | USD 120 million |

| Saint Lucia | 2015 – 2018 | USD 65 million |

| Turkey | 2017-2020 | USD 2.5 billion |

| Malta | 2014 – 2018 | EUR 1.2 billion |

| Cyprus | 2013 – 2018 | EUR 8 billion |

| Montenegro | 2018 – 2021 | EUR 200 million (projected from 2000 applications) |

*Unofficial figures

Existing citizenship funds

Citizenship by investment (CBI) programs have already helped create sovereign funds in several countries such as St Kitts, Antigua, Dominica, St Lucia and Grenada where in exchange for one time donation to the fund, citizenship for family can be acquired.

A list of citizenship funds maintained by governments funded by citizenship for sale programs.

| Sovereign Fund | Per Contribution | |

| St Kitts and Nevis | Sustainable Growth Fund (SGF) | $150,000 |

| Antigua and Barbuda | National Development Fund (NDF) | $100,000 |

| Dominica | Economic Diversification Fund (EDF) | $100,000 |

| Saint Lucia | National Economic Fund (NEF) | $100,000 |

| Grenada | National Transformation Fund (NTF) | $150,000 |

| Malta | National Development & Social Fund (NDSF) | €650,000 |

| Cyprus | Research and Development Fund Housing Development Fund |

€75,000 €75,000 |

Please contact us for more information.