Wealth tax is imposed on all assets. There are 7 only countries in the world that impose wealth tax. Major concerns about the highly unequal distribution of wealth, combined with the need for greater tax revenues in many countries during Covid period, have led to a renewed interest in wealth taxes.

The Origins of Wealth tax goes back to ancient greece, during the times of first money was invented during 600 BC. It was known ‘eisphorá’ levied on very wealth athenians during 400 BC. It was a flat fee, levied only when needed — usually in times of war. In the Islamic world, wealth tax (zakat) is common practice. It is a yearly religious duty, to pay 2.5 percent wealth tax on liquid assets.

Wealth tax is important consideration, cannot be ignored for HNWI, when considering citizenship and residence planning abroad.

The number of OECD countries levying individual net wealth taxes dropped from 12 in 1990 to 4 in 2017. This number slightly pickup 15+ as of 2023. Here are the list of countries levying wealth tax on assets and financial investments.

1. Spain

“Patrimonio” or millionaire tax rate is progressive, from 0.2 to 3.75% of net assets worldwide, above the threshold of €3 million euros. The exact amount varies between regions. From 3 million – 0.2%, €3-5 million -2.1%, Above 10 million, the highest rate of 3.75% applies.

2. Norway

Norway levies wealth tax of 0.85% of which 0.7% (municipal) and 0.15% (national) on net assets exceeding 1,500,000 kr (approx. US$170,000). 1.1% on exceeding NOK 20 million.

3. Switzerland

Wealth tax is levied against worldwide assets of Swiss residents, but it is not levied against assets in Switzerland held by non-residents. Most cantons have no wealth tax for individual net worth less than CHF 100,000. Wealth tax levied against net assets with a top rate ranging from 0.13% to 0.94% depending on canton and municipality of residence. Federal tax does not apply.

4. Belgium

The annual (wealth) tax at a rate of 0.15 percent on the value of certain securities accounts of individuals (both Belgian tax residents and nonresidents)

5. Argentina

Argentina implemented Covid wealth tax in Dec 2020 to tax millionaires who have assets over 200 million pesos ($2.5m). They pay a progressive rate of up to 3.5% on wealth in Argentina and up to 5.25% on that outside the country.

6. Netherlands

Wealth tax is levied on savings, property and investments

- 0.58% tax for € 30,361 to € 102,010 of assets,

- 1.34% for € 102,010 to € 1,020,096 and

- 1.68% on any euros of assets above € 1,020,096.

7. Italy

Italy imposes a wealth tax on financial investments owned outside of italy, charged rate is equal to 0.2% withheld by the bank. Real estate properties owned outside of Italy (IVIE): 0.76%;

8. Luxembourg

Wealth tax applies at the rate of 0.5% up to EUR 500 million and 0.05% for any amount in excess of EUR 500 million.

9. France

Wealth tax (IFI) has six brackets with tax ranges from 0% – 1.5%, exceeding 1.3 milliom euros.

10. Netherlands

Wealth tax known as “Box 2” tax, you pay tax on any substantial interests. You have a substantial interest if you, or you and a tax partner together, own at least 5% of the shares, options or profit-sharing certificates in a company. You pay 25% tax on income from substantial interests.

11.Liechtenstein

For any natural person resident in Liechtenstein, a wealth tax and income tax apply. The wealth tax applies to all kinds of assets, including movable and immovable assets. Movable and immovable assets are subject to wealth tax, levied based upon the fair market value. The taxable wealth is multiplied by a standard interest (2022: 4%) to calculate a notional income, which is subject to income tax together with other income.

12. Belgium

A solidarity tax of 0.15% is now applicable on securities accounts that reach or exceed EUR 1 million

13. Uruguay

For non-residents that are not subject to IRNR: 0.7% to 1.5%. For residents and non-residents subject to IRNR: 0.1% to 0.3%.

14. Moldova

The wealth tax is charged at 0.8% on the value of the real estate and holiday homes over 120 sq.m and valued above 2 million Lei.

15. Tunisia

New wealth tax introduced on immovable property assets, which is due at the rate of 0.5% on the value of property exceeding TND 3 million

16. Venezuela

Wealth tax Levied 0.25% on total assets.

17. Algeria

A wealth tax applies with rates varying from 0% (up to DZD 100 million) to 1% (for a value of holdings above DZD 450 million).

Source: PWC tax summaries

Note: The wealth tax structure can change from time to time. Please check with the tax authorities in the concerned country from time to time. The above information is only general information.

Wealth Tax Revenues

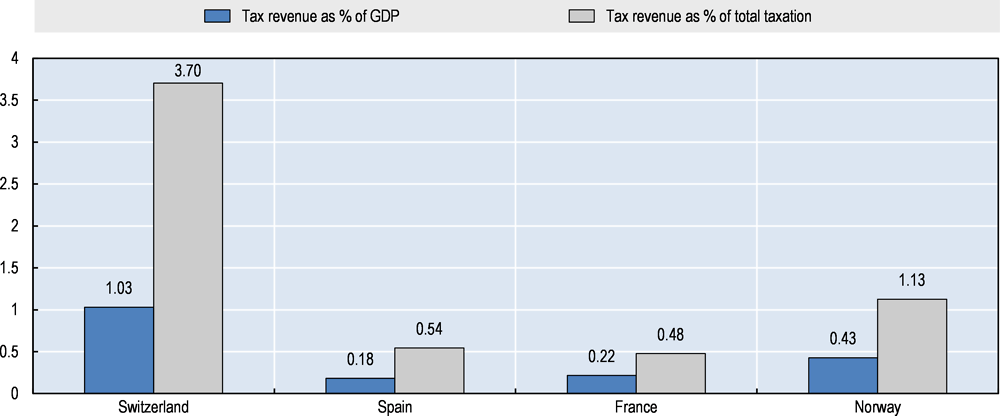

Wealth taxes have largely been unsuccessful in many countries, only accounted for a very small share of tax revenues. Switzerland has always stood out as an exception, with tax revenues from individual net wealth taxes which have been consistently higher than in other countries

Below is a chart that shows wealth tax collected in 2016

Source: OECD